LTC for Defence Personnel: Complete Guide to Leave Travel Concession (Rules, Eligibility & How to Claim)

In this article

Leave Travel Concession Guide

For India’s defence personnel, leave isn’t just about rest—it’s about reconnecting with family, exploring new parts of the country, and making memories. The Leave Travel Concession (LTC) is a valuable benefit that makes this possible by reimbursing eligible travel expenses for service members and their families.

In this guide, we will explain LTC rules, eligibility, claim process, tax implications, recent updates, and share practical tips for Army, Navy, and Air Force personnel.

What is Leave Travel Concession (LTC)?

The LTC scheme is a travel reimbursement benefit provided to Central Government employees, including Defence personnel. It covers the cost of travel for you and eligible family members when you take leave to visit your hometown or anywhere in India, within a set block of years.

Current LTC Block Years

LTC Block Year | Trips Allowed | Details |

|---|---|---|

2022–2025 | 1 hometown + 1 anywhere in India | You can also opt for 2 hometown trips |

2018–2021 | (Previous block) | Only applicable if carried forward |

Special Cases | Conversion allowed | Air travel entitlement for certain categories |

Tip: Plan your travel early in the block to avoid a last-minute rush before deadlines.

Who is Eligible for LTC in the Defence Forces

Leave Travel Concession (LTC) is a benefit extended to permanent employees of the Defence Forces, along with their eligible family members. Eligibility is defined clearly under Government rules, and understanding it helps you plan travel without facing claim rejections.

Eligible persons include:

- Spouse: Legally married partner.

- Children: Subject to dependency rules; generally, covers unmarried children up to the age of 25 years if still in education, and disabled children without any age limit.

- Dependent Parents: Must be financially dependent on the serving personnel.

- Dependent Brothers/Sisters: Must be unmarried, financially dependent, and living with the personnel.

Dependency Criteria: As per current rules, a family member is considered dependent if their monthly income is less than the amount prescribed in the government orders (linked to the minimum family pension).

Not Eligible:

- Retired Defence personnel unless re-employed in a Central Government post that offers LTC benefits.

- Friends or extended family members who do not fall under the dependency rules.

Types of LTC Trips

The LTC scheme is flexible, offering different types of travel entitlements depending on your choice and eligibility.

- Hometown LTC

- Covers travel from your duty station to your declared hometown.

- Can be availed once in a block (or more if converted from other LTC categories).

- Anywhere in India LTC

- Allows travel to any location within India, once per block period.

- Ideal for family vacations or visiting states you have never been to.

- Special Concession LTC

- For destinations like Jammu & Kashmir, North-East, Andaman & Nicobar Islands, and Ladakh.

- Offered in lieu of hometown or “anywhere” LTC, with relaxed frequency rules—you can travel more often to these areas under special provisions.

Tip: The “special concession” LTC often covers air travel even for those not normally entitled to it, making it a high-value option.

Recent Updates You Should Know

Keeping track of LTC updates is important so you can claim benefits without missing out. The latest changes include:

- New Train Inclusions

- Premium trains like Vande Bharat, Tejas, and Humsafar Express are now valid for LTC claims, expanding travel options for eligible personnel.

- Digital Ticket Submissions

- E-tickets with boarding passes are fully acceptable, eliminating the need for paper tickets. This simplifies claims for those booking online.

- LTC Cash Voucher Scheme

- You can opt to receive a cash benefit instead of travelling, provided you meet the spending requirements (spend 3x the fare amount on GST-registered goods/services using digital payments).

Step-by-Step: How to Claim LTC

Quick Reference Checklist

Before Travel:

- Leave sanction order from your unit or department.

- Confirmed travel tickets (flight, train, or bus).

- Proof of relation/dependency (if required for dependents).

- Ensure your travel fits within the current block year allowance.

After Travel:

- Boarding passes or original tickets.

- Travel bills and receipts.

- Completed LTC claim form.

- Bank details for reimbursement.

- Any required certificates (e.g., non-availability of rail ticket if using air travel when entitled only to train).

Claim Process

- Apply for Leave

- Mention LTC in your leave application. Get approval from your commanding officer or relevant authority.

- Book Travel

- Use approved carriers and the shortest route.

- For flights, book directly from the airline’s site or authorised agents.

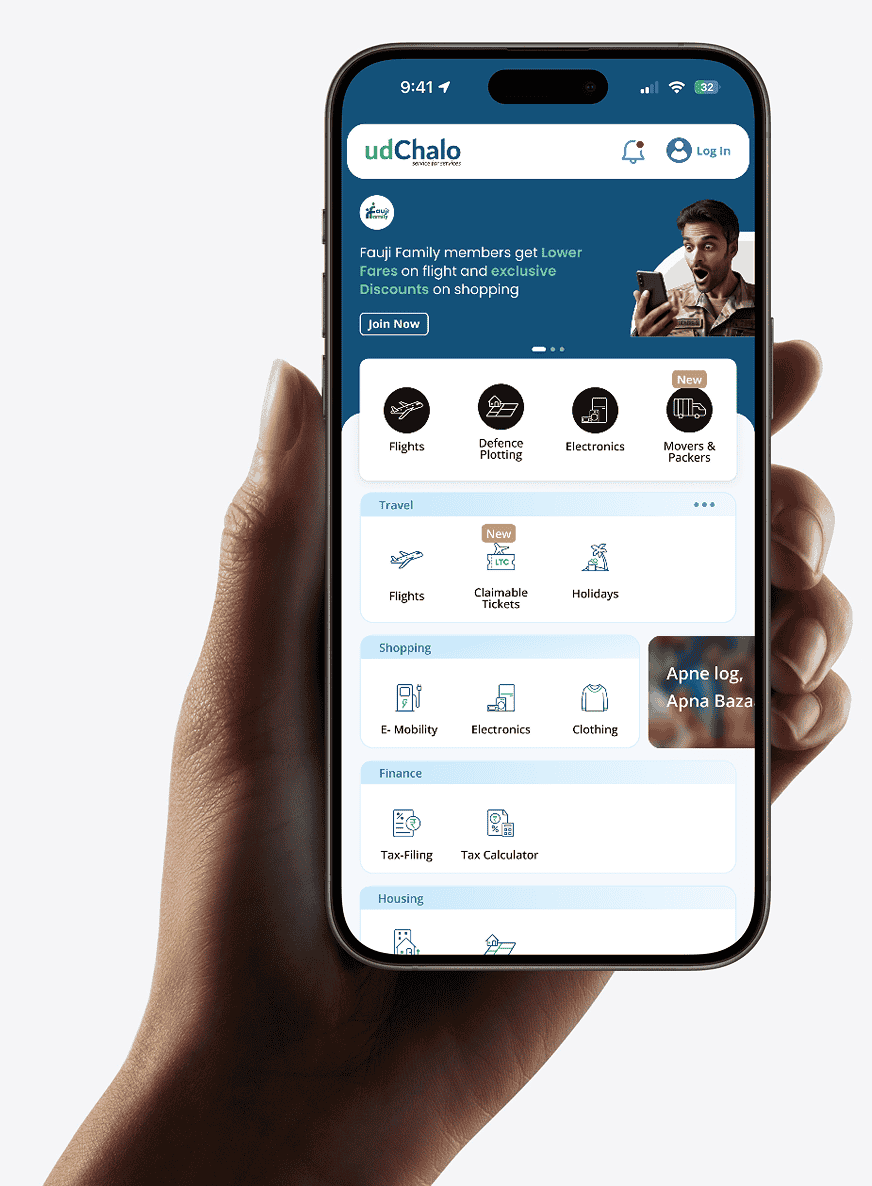

- ✅ Tip: Use udChalo Flights for LTC-compliant fares, defence discounts, and hassle-free documentation.

- Travel

- Keep all tickets, receipts, and boarding passes safe.

- Submit Claim

- Fill in the LTC claim form, attach all required documents, and submit it to your pay/admin office.

- Receive Reimbursement

- Payment is processed as per your entitlement and the actual fare rules.

In-Depth: Tax Rules for LTC

Under Section 10(5) of the Income Tax Act, LTC reimbursement is exempt from income tax if the following conditions are met:

- The travel is within India.

- The journey is in the eligible block year.

- The route taken is the shortest and matches your entitled class of travel.

Tax Points to Remember:

- Only two journeys in a block of 4 years qualify for tax exemption.

- Exemption applies only to the fare amount—accommodation, meals, and sightseeing costs are not exempt.

- If you use the LTC Cash Voucher Scheme, exemption is allowed only if you spend 3x the fare amount on GST-registered goods/services through digital payment methods.

📌 For personalised tax guidance and to maximise your LTC-related exemptions, visit udChalo Tax Services.

Special Concessions for Defence Personnel

Defence personnel enjoy certain flexibilities and concessions in LTC usage:

- Can combine LTC with casual leave or annual leave for longer trips.

- Special LTC provisions for difficult or remote postings—often including air travel entitlement.

- Flexible approval windows considering operational duties and leave availability.

Practical Tips to Maximise LTC

- Plan Early: Avoid peak season fare hikes and limited seat availability.

- Combine Trips: Use LTC alongside unit/block holidays for extended vacations.

- Choose High-Cost Destinations: Maximise reimbursement by using LTC for long-distance or expensive destinations.

Explore Remote Regions: Check udChalo Holidays for LTC-friendly packages to scenic and less-visited destinations.

Making the Most of Your LTC Benefits

LTC is not just a travel reimbursement—it’s an opportunity to explore, relax, and connect with your loved ones. With a little planning and the right information, you can make the most of your entitlements while keeping your expenses minimal.

Whether you’re heading home, exploring the Northeast, or booking a holiday package, udChalo is here to help you with LTC-friendly flight bookings, holiday packages, and tax filing support—so you can focus on the journey, not the paperwork.

Related Articles

Even with tight schedules, defence families can enjoy quick festival getaways. udChalo makes last-minute flight bookings easy, affordable, and stress-free, ensuring memorable family trips.

Escape the post-Diwali smog with trips to Bali, Dubai, Sri Lanka, Singapore, or the Andaman Islands. Enjoy cultural experiences, sightseeing, and exclusive flight discounts via udChalo for defence families.

Defence personnel can enjoy affordable and stress-free festival travel with exclusive flight deals via udChalo. Early booking, flexible schedules, and top routes ensure memorable celebrations with family and friends.

Frequent Asked Questions

Related Post

Even with tight schedules, defence families can enjoy quick festival getaways. udChalo makes last-minute flight bookings easy, affordable, and stress-free, ensuring memorable family trips.

Escape the post-Diwali smog with trips to Bali, Dubai, Sri Lanka, Singapore, or the Andaman Islands. Enjoy cultural experiences, sightseeing, and exclusive flight discounts via udChalo for defence families.

Defence personnel can enjoy affordable and stress-free festival travel with exclusive flight deals via udChalo. Early booking, flexible schedules, and top routes ensure memorable celebrations with family and friends.